The multinational company is headquartered in Germany and is a manufacturer of industrial automation, interconnection, and interface solutions. It is a lead investor in Thingple digital transformation solutions, investing in more than 20 Chinese companies similar to Thingple Inc. and building an ecosystem of partners. Its Chinese headquarters boasts over 2,500 local staff with 30 billion RMB in annual revenue.

Phoenix Contact’s first 30 years in China is a picture-perfect example of how MNCs prospered in China under its early reforms. The opening up of China invited the world to come and make the best use of its resources, its people, and its potential. China quickly became the world’s factory, a manufacturing base for nearly every useful, functional product the West created (the screen on which you’re reading this article now is likely made in China).

Yet the truth is, that MNCs such as Phoenix Contact have seen slowing revenue growth in recent years. Local Chinese companies with similar offerings, highly competitive prices, and comparable quality have been stepping in, eating into what was once considered markets with no peers. So what will the next 30 years look like for companies such as Phoenix Contact?

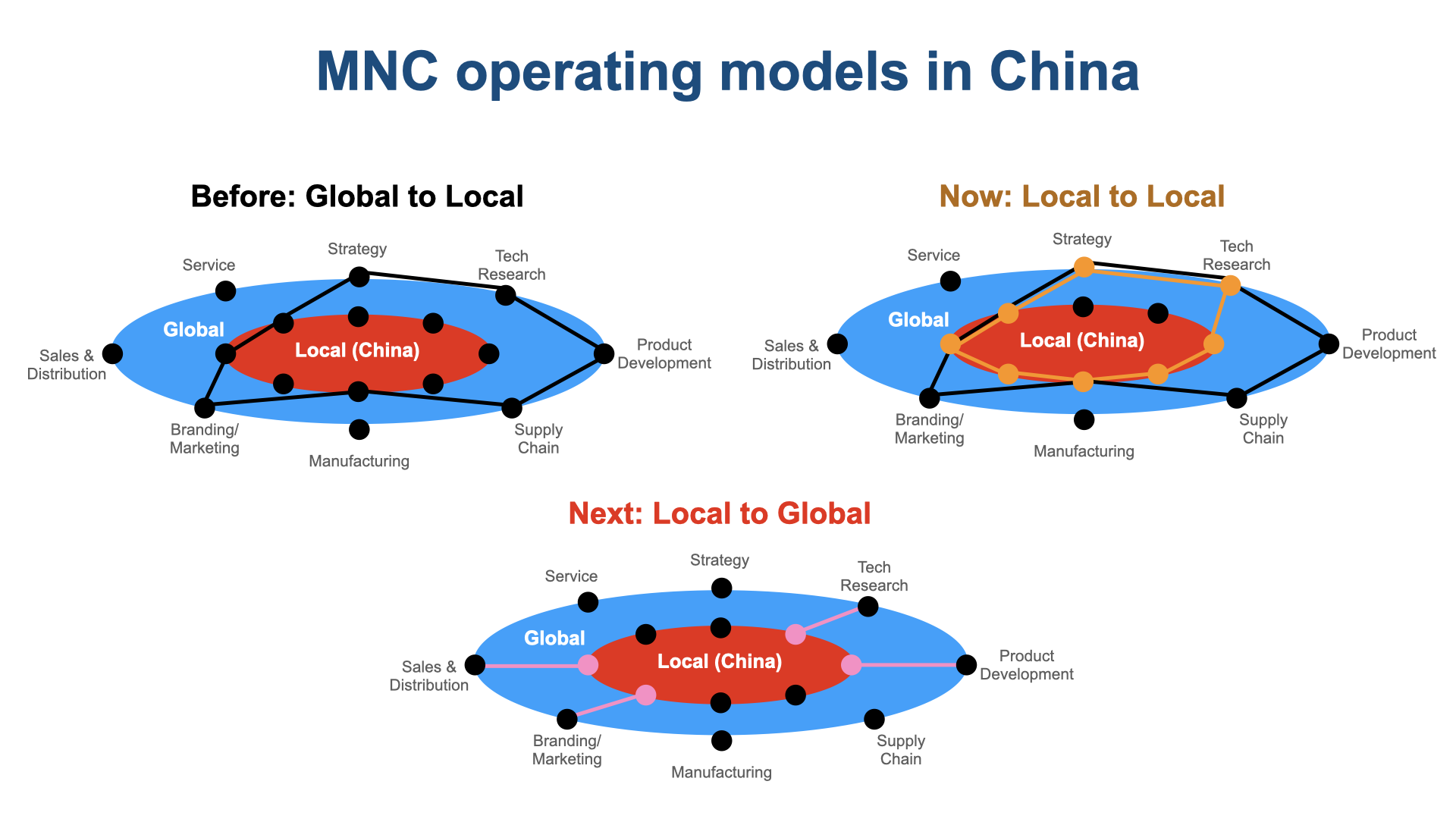

For many MNCs, the China business journey started in the 1990s with a ‘global for local’ strategy, which was to produce and sell Western products in China, taking advantage of its low-cost production and rapidly growing consumer market. Foreign brands held a special place in the hearts of domestic consumers and commanded premium prices. Whether it was consumer electronics, cars, or FMCG items, it was an opportunity to experience what the rest of the world was having. Back then, a long line of MNCs ventured into China, pouring billions into its economy and reaping profits.

As the years rolled by into the last decade or so, the Chinese market and its consumers matured and evolved. Consumers have become more worldly, more connected with global trends, and in many cases, have become more demanding. There has also been a notable rise in nationalist sentiment and the repositioning of ‘Made in China’ as a source of pride. Local manufacturers have picked up years of experience and lessons and applied them in their businesses and products. The level of innovation and quality has quickly caught up with the West. With a more sophisticated market, the ‘global for local’ strategy for MNCs in China was replaced with a ‘local for local’ strategy.

As Investopedia notes: “As of 2021, China has the second-largest economy in the world with a GDP of $17.7 trillion, behind the United States GDP of $22.9 trillion. If the economy were represented in purchasing power parity (PPP), China would edge out America as the largest economy with a purchasing power of more than $27.3 trillion.”

The ‘local for local’ strategy calls for greater product customization since domestic competition is fervent – as in Phoenix Contact’s case. As China’s supply chain becomes more sophisticated and complete, product development and supply chains have been shifted to China, in addition to manufacturing and sales. Relying on local talents for product development helps shorten product development cycles, allowing rapid responses to the market. Local supply chain partners helped to reduce costs, making products even more competitive. With the ‘local for local’ strategy, MNCs today – hanging on the hope that their foreign brand value holds a premium – are exposed to never-ending price wars, cutting profit margins thin.

Yet most MNCs working with the ‘local for local’ strategy continue to keep their core technology research, branding, and strategy outside of China. This approach is mired in the traditional smile chart, where the market believes China’s strength lies only in low-cost manufacturing. That’s no longer the case.

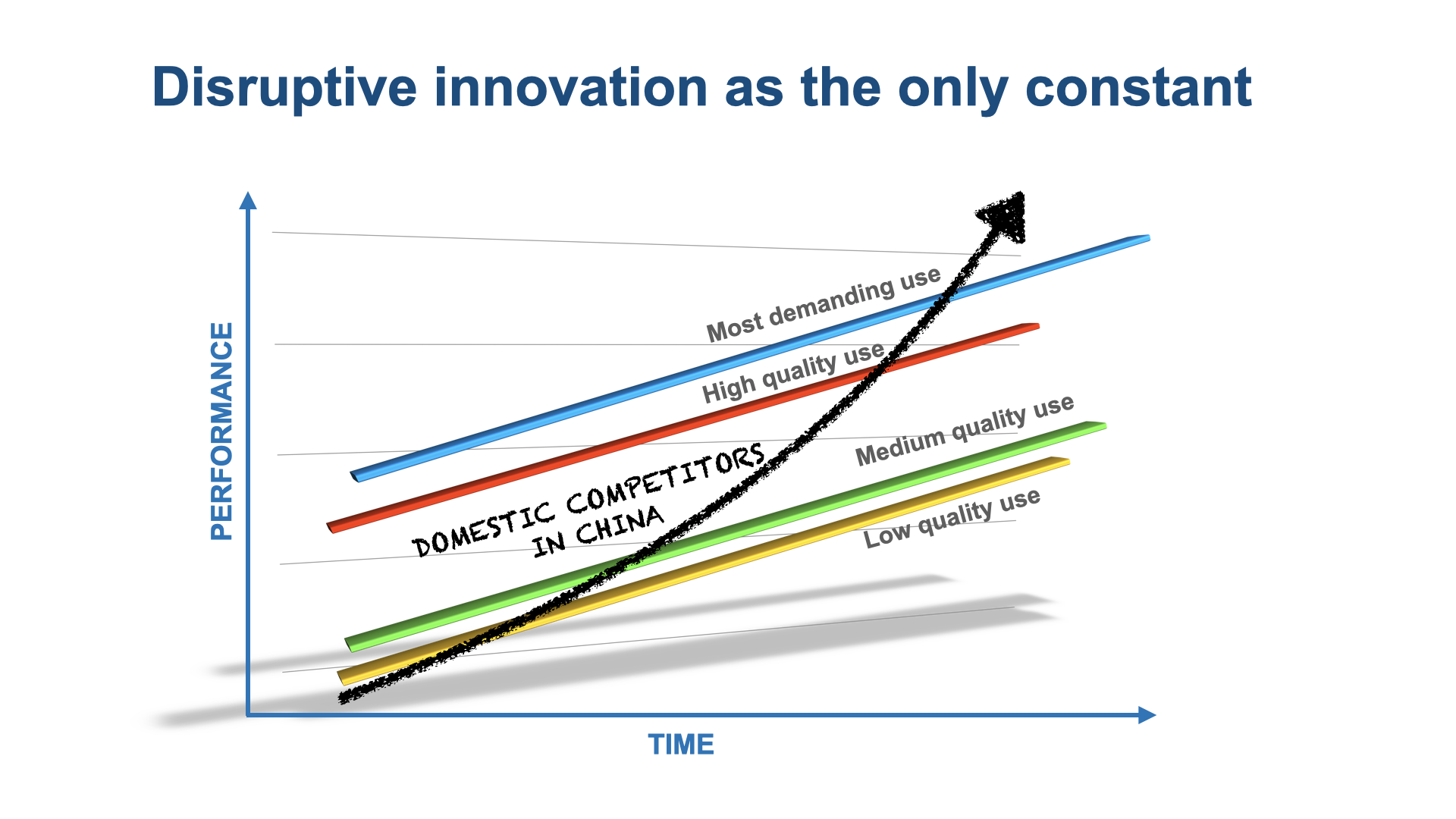

In the last 30 years, MNCs possessed strong positions in technology, product, quality, brand, and pricing, while Chinese companies held the lower end of the market with copycats. Over time, Chinese companies also started innovating, becoming increasingly competitive in mid- to high-end markets locally, and overseas.

Today, there are many examples of Chinese brands claiming significant overseas market share with breakthroughs in innovation and quality, not just cost. Chinese brands are seeing success in consumer electronics (Huawei, Vivo, Xiaomi), new energy vehicles (BYD, Nio, Xpeng), and even FMCGs such as affordable fashion (Shein) and consumables (Luckin Coffee).

As mentioned in Harvard Business Review’s article on China’s New Innovation Advantage, “To understand what’s powering the global rise of Chinese companies, we need to recognize that China now has at its disposal a resource that no other country has: a vast population that has lived through unprecedented amounts of change and, consequently, has developed an astonishing propensity for adopting and adapting to innovations, at a speed and scale that is unmatched elsewhere on earth.”

There is a well-known Chinese phrase: 三十年河东 三十年河西 (30 years a river flows east, 30 years a river flows west). This translates to how fortunes can change course over time, emphasizing a cyclical or impermanence of life. It suggests success and failure can alternate, and one should remain adaptable and not be overly complacent.

Well, now that the first 30 years have passed for Phoenix Contact – and many other MNCs from that era – what will the next 30 look like? How can MNCs today continue to grow in a disruptive Chinese market?

With the evolution of the industry, ability, talent, innovation, and even demands, here are four key suggestions for MNCs with a Chinese footprint to tackle the next three decades:

1. Replace the mindset ‘local for local’ with ‘local for global’

‘Local for local’ implies that local talents and local supply chains are only good enough for the Chinese domestic market, which implies low- to medium-quality use cases. ‘Local for global’ means treating domestic vendors as partners, leveraging innovation and product development capabilities for global markets. MNCs need to integrate the teams and make decisions by looking at and comparing strengths on a global scale.

2. Always include the Chinese market in global strategies

“When China sneezes, the world catches a cold” is a well-known adage to abide by. As China is now the world’s second-largest economy, global strategies must integrate what’s happening in the Chinese market. No ‘global strategy’ can succeed without considering strategic input from China

3. Chinese innovation is influencing global tech

Increasingly, high-quality use cases are growing in China. China is a leader in many fields today, such as internet and mobile applications, EVs and electrification, solar and wind, and digitization and IoT. These high-quality examples foster many advanced technologies and products, with innovations that can be applied to the global market. Many Chinese-innovated technologies are patented and leased to well-known multinational brands such as Apple, Samsung, VW, Audi, and more.

4. Co-create, not compete

Make a bigger pie instead of trying to cut it up. Rather than fighting in the same, limited market, it’s better to collaborate and co-create. Geo-political tensions and supply chain security issues are forcing continents to build independent manufacturing capacities, with little concern for demand. When manufacturing has over-capacity and margins are slashed, this inevitably creates a negative spiral. It’s more important than ever to co-create new applications and new products for new industries so that the added manufacturing capacity can be profitably and sensibly utilized.

In the 1997 book ‘The Innovator’s Dilemma’, author Clayton Christensen explains how even the most successful companies today can still lose their market leadership or even fail, as unexpected competitors step in and take over market share. The term ‘disruptive technologies’ was first mentioned, which is a disruptive innovation that potentially creates a new market and value network that will disrupt an existing market and replace existing products.

Which is what is happening right now with the Chinese marketplace and industry. Large, firm-footed MNCs such as Phoenix Contact are feeling the tremors, but there is a great opportunity to resolve the competition and build market share. The rise of Chinese innovation and its intentions to succeed cannot be ignored, and the best strategy forward is to embrace its progress to help achieve its ambitions – and yours.