In recent weeks U.S. investors have probably seen the headlines: China is a huge magnet for foreign capital. In 2020, despite the COVID-19 pandemic, China passed the United States as the world’s largest recipient of direct foreign investment, while its exchanges hosted half of the world’s 10 largest IPOs and four of the top five. Meanwhile, U.S. pension funds continue to pour money into big Chinese private equity deals—$13 billion between 2010 and 2019—despite geopolitical tensions and disappointment over the halted IPO of Chinese juggernaut Ant Group.

Investor interest in China is understandable: Last year, China’s was the only major economy in the world to see growth amid Covid-19. In particular, its business-to-consumer sector has made enormous strides. The country’s massive population and growing affluence make it almost irresistible from an investment standpoint.

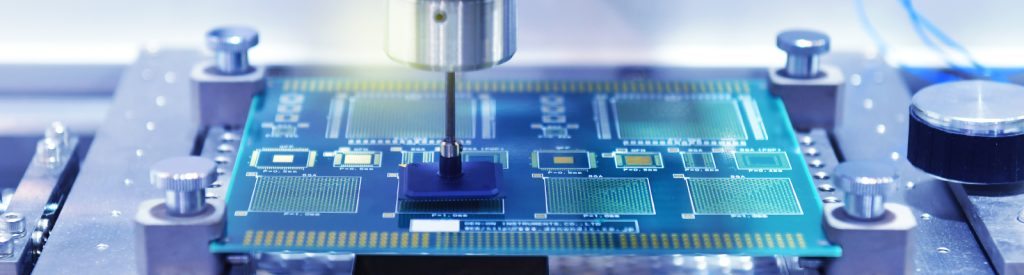

But for all the inflow of foreign capital, very little so far has gone into Chinese startups in arenas such as advanced materials and manufacturing, climate tech and others in the “hard technology” space, where perhaps the most intriguing developments are underway.

China is poised for enormous growth in these areas thanks to a confluence of government policy, education, and sheer market size. China’s spending on research and development jumped more than 10 percent last year, to a record $378 billion, and this month the government announced as a key new target for the 14th five-year plan to increase by 7 percent or more a year China’s R&D expenditures for 5G, quantum computing and other initiatives.

Previously, when foreign interests expanded to China, they took their own goods and methods. Today’s Chinese market is more dynamic and competent, bringing homegrown innovation to its domestic market and to overseas partners. Startups in this space have both the talent and government support to make innovative leaps more quickly than other countries and the size of the Chinese market alone suggests that if these startups can scale, they will produce returns consistent with those sought by venture capitalists.

That China has both the means and determination to innovate and compete globally in technology and other sectors is increasingly clear, not that it comes without complications that make some U.S. companies and investors wary. Yes, there have been other headlines, too: Geopolitical tensions complicate the picture. For example, China’s Semiconductor Manufacturing International Corp., which raised $7.5 billion on Shanghai’s tech-focused STAR market last year, was added to the trade blacklist by the Trump Administration.

But there is opportunity for savvy investors. Consider the climate space: A recent Goldman Sachs reportregarding China’s goal of becoming carbon neutral by 2060 projects $16 trillion in Chinese investment in that sector, creating 40 million new jobs. Plans for IT and cloud infrastructure are similarly ambitious. The technology for much of that is being developed in China. It represents a huge opportunity for Chinese industrial startups and foreign investors who choose to back them.

China’s entrepreneurial climate is strong. The profile of CEOs for industrial startups is one of experience and sophistication; unlike the earlier generation of young B2C entrepreneurs, including Jack Ma, who started companies based on little more than a vision, many of the entrepreneurs in hard tech are seasoned business leaders with technical expertise and, in some cases, experience working for multinational corporations. Some have even led public companies. These executives and their companies are in many cases geared to a venture-capital model and built for public listing or an M&A exit; in fact, a 2019 survey by Silicon Valley Bank found that more than half of Chinese startups expected their next source of funding to come from venture capital.

Also, the Chinese workforce is (as we have seen earlier in countries such as the United States) increasingly drawn to the startup world, where there is less bureaucracy and things move faster. China made a huge bet on education—more than 10% of Chinese citizens are now considered scientifically literate. So the talent is there. All of these factors point to an era of rapid innovation and industrialization.

It’s difficult, if not impossible, to predict what’s next concerning international trade relations, yet it’s worth noting that tensions tend to reinforce China’s commitment to developing its own hard-tech solutions. The “In China, for China” mindset, fueled by policy and enabled by educational strides, is producing hard-tech innovation that is increasingly competitive globally. China offers an entrepreneurial opportunity that foreign venture-capital investors would do well to explore.

Min Zhou is cofounder and CEO of CM Venture Capital in Shanghai.