Two years ago, in North Carolina, a US company called CREE was trying to sell its Wide-Bandgap (WBG) semiconductor business subsidiary Wolfspeed. Building on their expertise in Light Emitting Diodes (LEDs), government contracts for Gallium Nitride (GaN) lasers and commercial contracts for Silicon Carbide (SiC) voltage transformers, CREE had become one of the World leaders in WBG semiconductors. Cree found a buyer! Another World leader in the business, based in Neubiberg near Munich in Germany, called Infineon offered $850 M in cash for Wolfspeed. But they could not consummate the deal. The US government invoked national security and would not let Wolfspeed to be acquired by a foreign entity.

Around that time, we at CM Venture were investigating an investment in Global Power Technologies (GPT), a company based in Beijing, leader in the Chinese WBG semiconductor ecosystem. We liked the team, their enthusiasm, experience, and commitment. We liked the fact that it is a privately-owned company that built the only commercial SiC fab line in China despite lots of government entities trying. But most importantly, we liked the market, SiC in particular was finding exciting applications in power electronics, lightning arresters and Electric Vehicles (EVs). We even liked the business model, although they openly dismissed the asset-light fab-less approach of most Western start-ups in this business. They were going for an aggressive approach of building and owning a semiconductor fab themselves. The best WBG semiconductor fab in China! Only one thing was bothering us, the issue of timing. SiC semiconductor, like many other emerging technologies, had always been around-the-corner.

This is where the CREE situation was important. We pondered what was CREE management seeing that we were not? After all, they had been in the WBG semiconductor business for a long time. We remembered seeing their struggle with high-power LEDs, figuring out how to cool a 4-pack of 25W LEDs to make a 100W LED lamp for warehouse lighting applications. We had investigated several Chinese companies that had packaged a 100-pack of 1W LEDs for the same application and were facing only minor cooling challenges. CREE had followed the technologically harder route. They had a good patent portfolio. Why exit now when it finally looked bright? We concluded at the time that their management had decided to focus elsewhere but that there was nothing fundamentally wrong with the WBG semiconductor business. We invested in GPT.

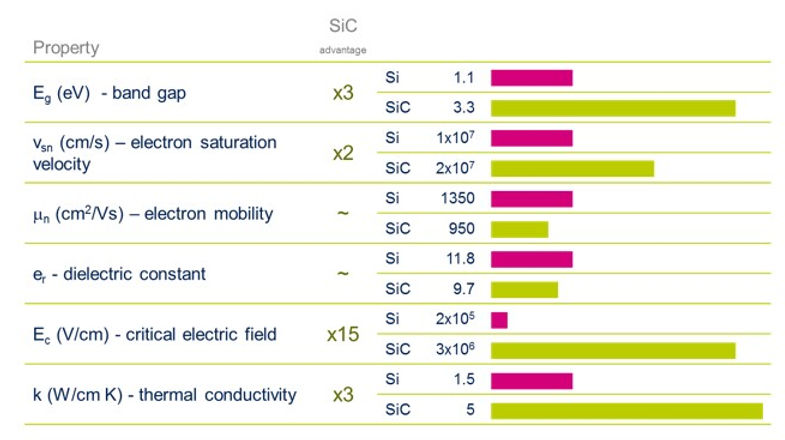

Then Elon Musk and his engineers decided to use SiC components inside the Tesla Model 3 power electronics. This made absolute sense. Toyota had demonstrated that a SiC-based solution was less than half the weight and half the volume of a Silicon-based solution. When incorporated on-board an EV, this was a no-brainer! Tesla investigated the suppliers in the business and settled on ST Microelectronics, a French-Italian company with a history of work on SiC design and fabrication. The product has worked perfectly with each Model 3 containing 24 SiC MOSFET transistors. And SiC is now penetrating the entire EV market.

GPT has grown exactly as expected. They are delivering SiC discrete components as fast as they make them. They are developing additional products swiftly. And they are planning to dramatically increase the size of their semiconductor fab.

As for the CREE story? It has changed its tune. Earlier this year, the company committed to a 1 billion USD investment to its Wolfspeed business, building a SiC semiconductor fab with an output 30 times larger than their previous fab. We are glad that we stuck with our own conviction two years ago. The time for Silicon Carbide is now!